UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ | Filed by a Party other than the Registrant ☐ |

Check the appropriate box:

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to |

P10, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

P10 INC.2023 Proxy Statement

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON DECEMBER 9, 2022

Dear P10 Inc. Stockholders:

Notice is hereby given that P10, Inc. (the “Company,” “P10,” “we,” “us” or “our”) will hold a special meeting of stockholders (the “Special Meeting”) on Friday, December 9, 2022 at 9:30 a.m. local time at 4514 Cole Ave, 3rd Floor, Dallas, TX 75205 for the following purposes:Annual Meeting of Stockholders

Notice is hereby given that the 2024 Annual Meeting of Stockholders of P10, Inc. (“P10” or the “Company”) will be held at the Westin New York Grand Central, Ambassador Meeting Room, located at 212 East 42nd Street, New York, NY at 9:00 a.m., local time, on Friday, June 14, 2024 for the following purposes: | Annual Meeting Information | ||||||

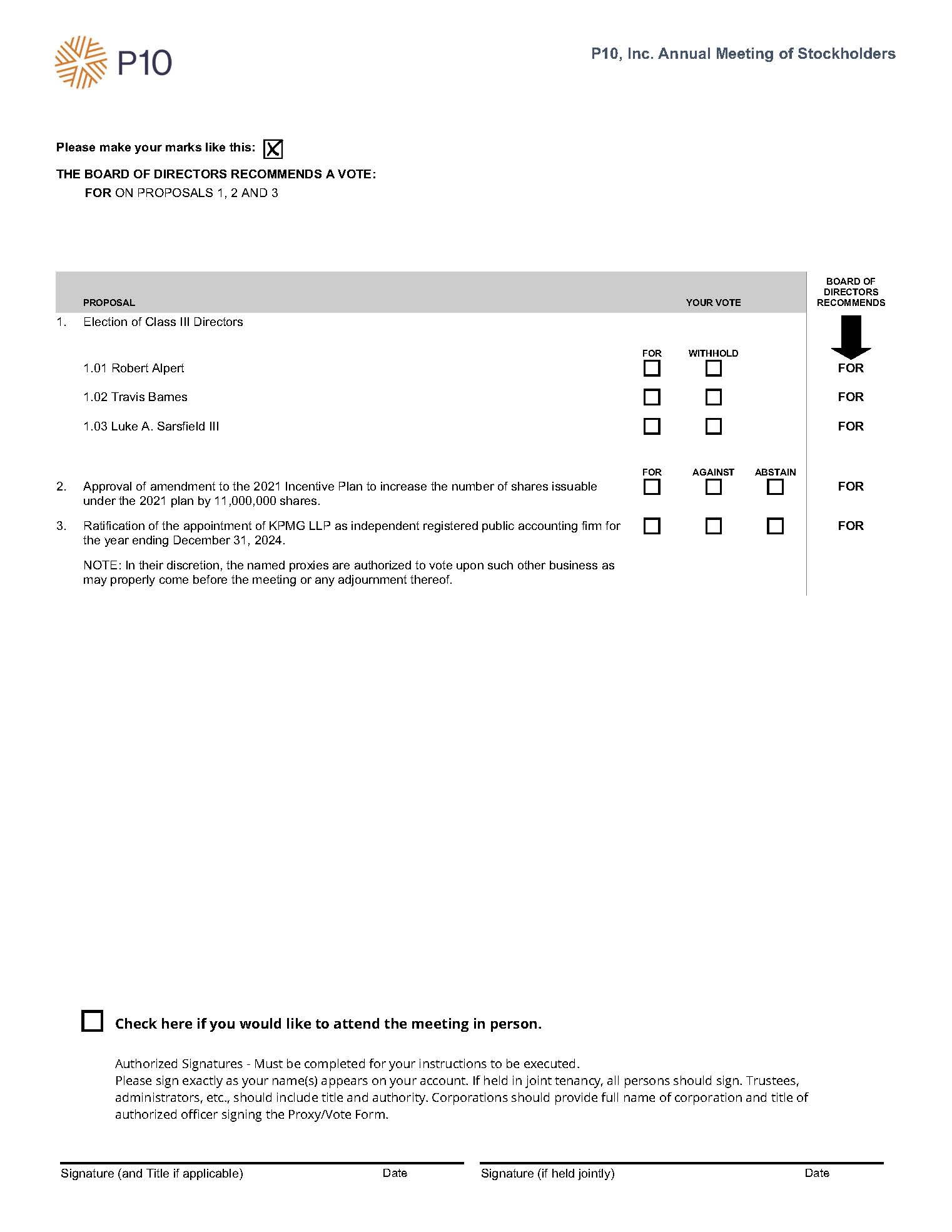

1. | To elect the following nominees as Class III Directors to serve for a term of three years: Robert Alpert, Travis Barnes and Luke A. Sarsfield III; | ||||||

2. | To approve an amendment to the P10, Inc. 2021 Incentive Plan (the | ||||||

3.

To ratify the selection of KPMG LLP as our Independent Registered Public Accounting Firm for our fiscal year ending December 31, 2024; and

Date and Time: Friday, June 14, 2024 9:00 a.m., local time Location: The Westin New York Grand Central Ambassador Meeting Room 212 East 42nd Street New York, NY 10017 Record Date: Close of Business April 18, 2024 Voting Information Your vote is important. Please vote via the Internet or telephone.

By Internet Visit:www.proxypush.com/PX

By Phone Call: 1-866-983-6559 | |||||||

4. | To transact | ||||||

These proposals are more fully described in the Proxy Statement following this Notice. The Board of Directors recommends that you vote (i) FOR the election of the three nominees to serve as Class III directors of the Company for a term of three years, (ii) FOR the approval of the amendment to the P10, Inc. 2021 Incentive Plan to increase the number of shares issuable under the 2021 Plan by 11,000,000 shares and (iii) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024. Along with the attached Proxy Statement, we are sending you a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2023. The Board of Directors has fixed the close of business on April 18, 2024 as the record date for the determination of the stockholders entitled to notice of, and to vote at, the Annual Meeting. Accordingly, only stockholders of record at the close of business on that date will be entitled to vote at the Annual Meeting. A list of the stockholders of record as of the close of business on April 18, 2024 will be available for inspection by any of our stockholders for any purpose germane to the Annual Meeting during normal business hours at our principal executive offices, 4514 Cole Ave, Suite 1600, Dallas, TX 75205, beginning on June 4, 2024 and at the Annual Meeting. Stockholders are cordially invited to attend the Annual Meeting in person. Regardless of whether you plan to attend the Annual Meeting, please mark, date, sign and return the enclosed proxy, or vote by internet or telephone, to ensure that your shares are represented at the Annual Meeting. By Order of the Board of Directors, Robert Alpert Robert Alpert Executive Chairman and Chairman of the Board April 24, 2024 | |||||||

The Board of Directors recommends that you vote FOR the approval of the amendment to the P10, Inc. 2021 Incentive Plan to increase the number of shares issuable under the 2021 Plan by 4,000,000 shares.

Only stockholders as of the record date, November 10, 2022 (the “Record Date”), or their duly appointed proxies, may attend the Special Meeting. If you hold your shares in “street name” (that is, through a broker, bank or other intermediary or nominee), your name does not appear in the Company’s records, so you will need to bring a copy of your brokerage statement reflecting your ownership of shares of Class A common stock as of the Record Date to attend the Special Meeting and a legal proxy if you wish to vote at the Special Meeting.

Stockholders are cordially invited to attend the Special Meeting in person. Regardless of whether you plan to attend the Special Meeting, please mark, date, sign and return the enclosed proxy, or vote by internet or telephone, to ensure that your shares are represented at the Special Meeting.

Your vote is very important. Whether or not you plan to attend the Special Meeting, we encourage you to read the proxy statement and vote as soon as possible.

| Important notice regarding the availability of proxy materials for the | |

| ||

2024 Proxy Statement |

|

| ||

| ||

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE STOCKHOLDER MEETING TO BE HELD ON DECEMBER 9, 2022

The NoticeTable of Special Meeting of Stockholders and the accompanying proxy statement are available at www.p10alts.com and www.proxydocs.com/PX. These proxy materials are first being sent or made available to stockholders commencing on or about November 15, 2022.

YOUR VOTE IS IMPORTANT

Please vote via the Internet or telephone.

Internet: www.proxypush.com/PX

Phone: 1-866-983-6559

FOR SPECIAL MEETING OF STOCKHOLDERSContents

2 | |||

2 | |||

2 | |||

5 | |||

7 | |||

7 | |||

11 | Board Meetings; Corporate Governance; Committees and Membership | ||

18 | |||

19 | |||

23 | |||

23 | |||

30 | |||

31 | Proposal 3: Ratification of Independent Registered Public Accounting Firm | ||

32 | |||

33 | |||

39 | |||

| ||||

| 1 |

| |||||

P10, Inc.

4514 Cole Ave, Suite 1600, Dallas, TX 75205

FOR SPECIALANNUAL MEETING OF STOCKHOLDERS

PROXY SUMMARYJune 14, 2024

Proxy Summary

This summary highlights certain information contained elsewhere in our proxy statement.Proxy Statement. This summary does not contain all the information that you should consider, and you should carefully read the entire proxy statementProxy Statement and our 2023 Annual Report to Stockholders before voting. The Notice of SpecialAnnual Meeting of Stockholders, and the accompanying proxy statementProxy Statement and our 2023 Annual Report to Stockholders are available at www.p10alts.com and www.proxydocs.com/www.proxypush.com/PX and are first being sent or made available to stockholders commencing on or about November 15, 2022.April 24, 2024 and mailed on or about April 26, 2024.

ABOUT THE MEETINGAbout the Meeting

What is the date, time and place of the specialannual meeting?

P10 Inc.’s 2022 Special2024 Annual Stockholders’ Meeting will be held on Friday, December 9, 2022June 14, 2024 beginning at 9:3000 a.m., local time, at 4514 Cole Ave, 3rd Floor, Dallas, TX 75205.the Westin New York Grand Central, Ambassador Meeting Room, located at 212 East 42nd Street, New York, NY 10017.

What is the purpose of the specialannual meeting?

At the specialannual meeting, stockholders will act upon the matters outlined in the notice of meeting on the cover page of this proxy statement,Proxy Statement, consisting of (1) the election of Class III directors; (2); an amendment to the P10, Inc. 2021 Incentive Plan (the "2021 Plan") to increase the number of the Company’s shares issuable under the 2021 Plan by 4,000,00011,000,000 shares; (3) the ratification of the appointment of KPMG LLP as P10’s independent registered public accounting firm for the year ending December 31, 2024; and (2)(4) any other matters that properly come before the meeting.

What are the voting rights of the holders of our common stock?

Each share of our Class A common stock will entitle its holder to one vote on all matters to be voted on by stockholders generally.

Each share of our Class B common stock will entitle its holder to ten votes until a Sunset becomes effective. After a Sunset becomes effective, each share of our Class B common stock will automatically convert into Class A common stock. The Class B Holders have approximately 95%91% of the combined voting power of our common stock.

A “Sunset” is triggered by any of the earlier of the following:

•

•

•

Holders of Class B common stock may elect to convert shares of Class B common stock on a one-for-one basis into Class A common stock at any time. Holders of our Class A common stock and Class B common stock will vote together as a single class on all matters presented to our stockholders for their vote or approval, except as set forth in our amended and restated certificate of incorporation or as otherwise required by applicable law.

P10, Inc. entered into a controlled company agreement (the “Controlled Company Agreement”), with principals of 210 Capital, LLC (“210 Capital”) and certain of their affiliates (the “210 Group”), RCP Advisors 2, LLC and RCP Advisors 3, LLC (collectively, “RCP Advisors”) and certain of their affiliates (the “RCP Group”), and TrueBridge Capital Partners LLC and certain of their affiliates (the “TrueBridge Group”), granting each party certain board designation rights. So long as the 210 Group and any of their permitted transferees continue to collectively hold a combined voting power of (A) at least 10% of the shares of common stock outstanding immediately following the closing date of our initial public offering (the “Closing Date”), P10, Inc. shall include in its slate of nominees two (2) directors designated by the 210 Group and (B) less than 10% but at least 5% of the shares of common stock outstanding immediately following the Closing Date, one (1) director designated by the 210 Group. So long as the RCP Group and any of their permitted transferees continue to collectively hold a combined voting power of at least 5% of the shares of common stock outstanding immediately following our initial public offering, P10, Inc. shall include in its slate of nominees one (1) director designated by the RCP Group. So long as the TrueBridge Group and any of their permitted transferees continue to collectively hold a combined voting power of at least 5% of the shares of common stock outstanding immediately following our initial public offering, P10, Inc. shall include in its slate of nominees one (1) director designated by the TrueBridge Group.

2 | P10, Inc. |

Proxy Summary | |

The 210 Group, the RCP Group and TrueBridge Group have the right to designate two, one and one directors, respectively. In addition, the parties to our Controlled Company Agreement will agree to elect at least three directors who are not affiliated with any party to our Controlled Company Agreement and who satisfy the independence requirements applicable to audit committee members established pursuant to Rule 10A-3 under the Exchange Act. These board designation rights are subject to certain limitations and exceptions.

Who is entitled to vote at the special meeting?

Only our stockholders of record at the close of business on November 10, 2022,April 18, 2024, the record date for the meeting, are entitled to receive notice of and to participate in the specialannual meeting. If you were a stockholder of record on that date, you will be entitled to vote all of the shares you held on that date at the meeting, or any postponement(s) or adjournment(s) of the meeting. As of the record date, there were 40,911,41654,592,372 shares of Class A common stock outstanding and 76,142,24258,430,223 shares of Class B common stock outstanding, all of which are entitled to be voted at the specialannual meeting. Whether or not you plan to attend the meeting, we encourage you to fill out and return the proxy card or vote by proxy over the telephone or on the Internet as instructed below to ensure your vote is counted.

A list of stockholders will be available at our headquarters at 4514 Cole Ave, Suite 1600, Dallas, TX 75205 for a period of ten days prior to the annual meeting and at the annual meeting itself for examination by any stockholder.

What is the difference between a stockholder of record and a beneficial owner of shares held in street name?

|

|

Who can attend the special meeting?

All stockholders as of the record date, or their duly appointed proxies, may attend the special meeting. Please also note that if you hold your shares in “street name” (that is, through a broker or other nominee), you will need to bring a copy of a brokerage statement reflecting your stock ownership as of the record date, to attend the meeting, and you will need to bring a signed proxy from your broker in order to vote your shares at the meeting.

What constitutes a quorum?

The presence at the meeting, in person or by proxy, of the holders of common stock representing a majority of the combined voting power of the outstanding shares of stock on the record date will constitute a quorum, permitting the meeting to conduct its business. As of the record date, there were 40,911,41654,592,372 shares of Class A common stock outstanding and 76,142,24258,430,223 shares of Class B common stock outstanding, all of which are entitled to be voted at the specialannual meeting, and therefore holders of common stock representing 401,166,919319,447,302 combined voting power will constitute a quorum.

What vote is required to approve each item?

The affirmative vote of a majority of the combined voting power of the shares of common stock present at the meeting in person or by proxy and entitled to vote is required for the approval of the amendment to the 2021 Incentive Plan and approval of any other matter that may be properly submitted to a vote of our stockholders.

The inspector of election for the specialannual meeting shall determine the number of shares of common stock represented at the meeting, the existence of a quorum and the validity and effect of proxies, and shall count and tabulate ballots and votes and determine the results thereof. Proxies received but marked as abstentions and broker non-votes will be included in the calculation of the number of shares considered to be present at the meeting for purposes of determining a quorum, and accordingly will count asquorum. If less than a vote against Proposal 1.

Broker non-votes, if any, count as presentmajority of the combined voting power of the outstanding shares of common stock is represented at the specialannual meeting, a majority of the shares so represented may adjourn the annual meeting from time to time without further notice.

The table below describes the vote requirements and the effect of abstentions and broker non-votes, as prescribed under our bylaws, the rules of the New York Stock Exchange and Delaware law, for the purposeselection of determining a quorum.directors and the approval of the other items on the agenda for the annual meeting.

Proposal | Vote Required | Effect of Abstentions and Broker Non-Votes* |

Proposal 1: Election of the three nominees to serve as Class III directors of the Company | Plurality of the votes cast. | Abstentions and broker non-votes will have no effect on the outcome of the election. |

Proposal 2: Approval of the amendment to the P10, Inc. 2021 Incentive Plan to increase the number of shares issuable under the 2021 Plan | Affirmative vote of the holders of a majority in combined voting power of the votes cast. | Abstentions and broker non-votes will have no effect on the outcome. |

Proposal 3: Ratification of the appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2024 | The affirmative vote of a majority of the combined voting power of the shares of common stock present at the meeting in person or by proxy and entitled to vote. | Abstentions will have the effect of a vote against. |

2024 Proxy Statement | 3 |

Proxy Summary | |

___________________

* A broker non-vote occurs when a broker bank or other nominee holding shares forsubmits a beneficial owner votes on one proposalproxy but does not vote on anothera proposal because with respect to such other proposal,it is not a “routine” item under NYSE rules and the nominee does not have discretionary voting power andbroker has not received voting instructions from the beneficial owner. Since the approvalowner of the Amendmentshares. Broker non-votes will not be counted as “votes cast” with respect to P10’s Incentive Plan (Proposal No. 1) is considered non-routine under applicable rules, and there are no other proposals expected to be considered atProposals 1 or 2. Your broker may vote without your instructions only on Proposal 3—Ratification of the Special Meeting, no broker non-votes are expected to occur at the meeting.appointment of KPMG LLP as our independent registered public accounting firm for fiscal 2024.

What are the Board’s recommendations?

OurAs more fully discussed under Summary of Matters to be Voted On, our Board of Directors recommends a votevote: (i) FOR the election of the three nominees to serve as Class III directors of the Company for a term of three years; (ii) FOR the approval of the amendment to the P10, Inc. 2021 Incentive Plan to increase the number of shares issuable under the 2021 Plan by 4,000,000 shares.11,000,000 shares; and (iii) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

Unless contrary instructions are indicated on the enclosed proxy, all shares represented by valid proxies received pursuant to this solicitation (and which have not been revoked in accordance with the procedures set forth below) will be voted: (i) FOR the election of each of the three nominees to serve as Class III directors of the Company for a term of three years; (ii) FOR the approval of the amendment to the P10, Inc. 2021 Incentive Plan to increase the number of shares issuable under the 2021 Plan by 4,000,000 shares,11,000,000 shares; (iii) FOR the ratification of the appointment of KPMG LLP as our independent registered public accounting firm for the fiscal year ending December 31, 2024, and (ii)(iv) in accordance with the recommendation of our Board of Directors, FOR or AGAINSTon all other matters as may properly come before the specialannual meeting. In the event a stockholder specifies a different choice by means of the enclosed proxy, such shares will be voted in accordance with the specification made.

How do I vote?

If you are aholder of record (that(that is, if your shares are registered in your own name with our transfer agent), you may vote using the enclosed proxy card. Voting instructions are provided on the proxy card contained in the proxy materials. Holders of record may vote their shares by regular mail, by phone at 1-866-983-6559, online at www.proxypush.com/PX, or in person at the SpecialAnnual Meeting.

If you are astreet name holder (that(that is, if you hold your shares through a bank, broker or other holder of record), you must vote in accordance with the voting instruction form provided by your bank, broker or other holder of record. The availability of telephone or internet voting will depend upon your bank’s, broker’s, or other holder of record’s voting process.

If you come to the SpecialAnnual Meeting, you can, of course, vote in person. If you are a street name holder and wish to vote at the meeting, you must first obtain a proxy from your bank, broker or other holder of record authorizing you to vote.

Can I change my vote after I return my proxy card?

Yes. The giving of a proxy does not eliminate the right to vote in person should any stockholder giving the proxy so desire. Stockholders have an unconditional right to revoke their proxy at any time prior to the exercise of that proxy, by voting in person at the specialannual meeting, by filing a written revocation or duly executed proxy bearing a later date with our Secretary at our headquarters.

Who pays for costs relating to the proxy materials and specialannual meeting of stockholders?

The costs of preparing, assembling and mailing this proxy statement,Proxy Statement, the Notice of SpecialAnnual Meeting of Stockholders and the enclosed Annual Report and proxy card, along with the cost of posting the proxy materials on our website, are to be borne by us. In addition to the use of mail, our directors, officers and employees may solicit proxies personally and by telephone, facsimile and other electronic means. They will receive no compensation in addition to their regular salaries. We may request banks, brokers and other custodians, nominees and fiduciaries to forward copies of the proxy material to their principals and to request authority for the execution of proxies. We may reimburse these persons for their expenses in so doing. We have retained InvestorCom, LLC to aid in the solicitation at an estimated cost of $6,500$5,000 plus reimbursable out-of-pocket expenses.

4 | P10, Inc. |

Stock Ownership | |

Stock Ownership

The following table shows information regarding the beneficial ownership of our common stock for the following:

All information is as of the record date, April 18, 2024, except as noted otherwise. On such date, there were 54,592,372 shares of Class A common stock outstanding with the right to one vote per share on each matter to come before the meeting, 58,430,223 shares of Class B common stock outstanding with the right to ten votes per share on each matter to come before the meeting, and all outstanding shares have a combined voting power of 638,894,602 votes. The address for directors, director nominees and executive officers is c/o P10, Inc., 4514 Cole Avenue, Suite 1600 Dallas, Texas 75205.

Name of Beneficial Owner |

| Class A |

|

|

| Class B |

|

| Combined |

|

| Percent of |

|

| Percent of |

|

| Percent of |

| ||||||

Beneficial Owners of More Than 5% of Any Class |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

T. Rowe Price Investment Management, Inc. |

|

| 5,491,374 |

|

|

|

| — |

|

|

| 5,491,374 |

| (2) |

| 10.1 | % |

| * |

|

| * |

| ||

Alliance Bernstein L.P. |

|

| 2,908,710 |

|

|

|

| — |

|

|

| 2,908,710 |

| (3) |

| 5.3 | % |

| * |

|

| * |

| ||

Kent P. Dauten |

|

| 6,583,090 |

|

|

|

| — |

|

|

| 6,583,090 |

| (4) |

| 12.1 | % |

| * |

|

| * |

| ||

The Vanguard Group |

|

| 4,215,936 |

|

|

|

| — |

|

|

| 4,215,936 |

| (5) |

| 7.7 | % |

| * |

|

| * |

| ||

RCP Group Holders |

|

| 1,009,133 |

| (6) |

|

| 21,900,253 |

|

|

| 220,011,663 |

| (6) |

| 1.8 | % |

|

| 37.5 | % |

|

| 34.4 | % |

TrueBridge Group Holders |

|

| 108,287 |

| (7) |

|

| 17,543,995 |

|

|

| 175,548,237 |

| (7) | * |

|

|

| 30.0 | % |

|

| 27.5 | % | |

210 Group Holders |

|

| 5,018,486 |

| (8) |

|

| 9,667,397 |

|

|

| 101,692,456 |

| (8) |

| 9.2 | % |

|

| 16.5 | % |

|

| 15.9 | % |

Directors, Director Nominees and Named Executive Officers |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Robert Alpert (member of the 210 Group Holders) |

|

| 4,259,243 |

|

|

|

| 9,667,397 |

|

|

| 100,933,213 |

| (8) |

| 7.8 | % |

|

| 16.5 | % |

|

| 15.8 | % |

C. Clark Webb (member of the 210 Group Holders) |

|

| 4,259,243 |

|

|

|

| 9,667,397 |

|

|

| 100,933,213 |

| (8) |

| 7.8 | % |

|

| 16.5 | % |

|

| 15.8 | % |

William F. Souder (member of the RCP Group Holders)(9) |

|

| 254,355 |

|

|

|

| 4,261,939 |

|

|

| 42,873,745 |

|

| * |

|

|

| 7.3 | % |

|

| 6.7 | % | |

David M. McCoy (member of the RCP Group Holders) |

|

| 80,600 |

|

|

|

| 2,817,213 |

|

|

| 28,252,730 |

| (6) | * |

|

|

| 4.8 | % |

|

| 4.4 | % | |

Robert B. Stewart Jr. |

|

| 91,305 |

|

|

|

| 13,291 |

|

|

| 224,215 |

|

| * |

|

| * |

|

| * |

| |||

Travis Barnes |

|

| 25,215 |

|

|

|

| 13,291 |

|

|

| 158,125 |

|

| * |

|

| * |

|

| * |

| |||

Scott Gwilliam |

|

| 225,215 |

|

|

|

| 631,186 |

|

|

| 6,537,075 |

|

| * |

|

|

| 1.1 | % |

|

| 1.0 | % | |

Tracey Benford |

|

| — |

|

|

|

| — |

|

|

| — |

|

| * |

|

| * |

|

| * |

| |||

Edwin Poston (member of the TrueBridge Group Holders) |

|

| 54,103 |

|

|

|

| 8,849,584 |

|

|

| 88,549,943 |

| (7)(10) | * |

|

|

| 15.1 | % |

|

| 13.9 | % | |

Amanda Coussens |

|

| 22,174 |

|

|

|

| — |

|

|

| 22,174 |

| (11) | * |

|

| * |

|

| * |

| |||

Luke Sarsfield |

|

| 63,329 |

|

|

|

| — |

|

|

| 63,329 |

|

| * |

|

| * |

|

| * |

| |||

All directors, director nominees and executive officers as a group (12 persons) |

|

| 5,721,166 |

|

|

|

| 21,991,962 |

|

|

| 225,640,786 |

|

|

| 10.5 | % |

|

| 37.6 | % |

|

| 35.3 | % |

* Less than one percent (1%)

Stock Ownership | |

6 | P10, Inc. |

Matters to Come Before the Annual Meeting | |

Matters to Come Before the Annual Meeting

PROPOSAL 11:

AMENDMENT TO THE 2021 INCENTIVE PLAN TO INCREASEElection of Directors

THE NUMBER OF SHARES ISSUABLE UNDER THE 2021 PLANNominees

Our Board of Directors currently has nine members, four of whom are independent directors. Our amended and restated certificate of incorporation and bylaws classifies our Board of Directors into three classes of directors, serving staggered three-year terms of office. Directors designated as Class III directors have initial terms expiring at this Annual Meeting. Directors up for election at this Annual Meeting may be elected to a new three-year term expiring in 2027. Directors designated as Class I directors have terms expiring at our 2025 Annual Meeting of Stockholders. Directors designated as Class II directors have terms expiring at our 2026 Annual Meeting of Stockholders. There are no family relationships among any of our directors, executive officers or nominees.

Listed below are the nominees for election at the annual meeting to serve as Class III directors on our Board of Directors, along with the continuing Class I and Class II directors.

Nominees for Election as Class III Directors at the Annual Meeting (Term to Expire 2027)

Robert Alpert |

Title: Executive Chairman and Chairman of the Board | Age: 59 | Director Since: 2017 |

Career Highlights Mr. Alpert is one of the two directors designated by the 210 Group and served as the Company’s Chairman of the Board since 2017. He also served as the Company’s Co-Chief Executive Officer from 2017 until October 2023. Mr. Alpert brings to the board extensive investment and managerial experience. In addition to his role at P10, Mr. Alpert is also the co-founder and principal of 210 Capital. Additionally, he is the Chairman of the Board of Crossroads Impact Corp. and a director of Elah Holdings, lnc. Mr. Alpert is also a managing member of Merfax Financial Group, LLC, an investment fund and the controlling shareholder of Incline Insurance Group, LLC, a national property and casualty insurance company, and a director of Redpoint Insurance Group, LLC, an insurance holding company. He was formerly CEO (April 2019-September 2020) and Chairman of the Board of Globalscape, Inc., a software developer offering secure enterprise FTP solutions. Before founding 210 Capital, Mr. Alpert was the founder and portfolio manager of Atlas Capital Management, L.P. (October 1995 to September 2015). Mr. Alpert received a B.A. from Princeton University in 1987 and an M.B.A. from Columbia University in 1990. Committees: • N/A |

Travis Barnes |

Title: Director | Age: 48 | Director Since: 2021 |

Career Highlights Mr. Barnes brings to the board extensive experience in financial services and impact lending. Mr. Barnes is a Managing Director and Global Co-Head of Capital Markets, serving on the Investment Banking Management Team at Barclays, a multinational universal bank. Previously, he was the global head of Debt Capital Markets and Risk Solutions Group, which also included Securitized Products Origination, Sustainable Capital Markets, Loan Capital Markets and Global Finance Advisory. Mr. Barnes is the Chair of Barclays’ Americas Citizenship Council. He is based in New York and has worked at Barclays since 2006. He started his career at Morgan Stanley and worked in Debt Capital Markets, Corporate Finance and Mergers & Acquisitions, based in New York and Hong Kong. Mr. Barnes received a B.A., summa cum laude, in Economics and English from Lafayette College in 1998. He has served as a director of the Company since October 2021. Committees: • Audit • Compensation |

Luke A. Sarsfield III |

Title: Chief Executive Officer and Director | Age: 50 | Director Since: 2023 |

Career Highlights Mr. Sarsfield is the Company’s Chief Executive Officer, a position he has served in since October 2023. Prior to joining P10, Mr. Sarsfield worked at Goldman Sachs for over 23 years, where he held numerous senior leadership roles in asset management, including: Global Co-Head of Goldman Sachs Asset Management, Chief Commercial Officer of Asset and Wealth Management, and Global Co-Head of the Client Business within Goldman Sachs Asset Management. Previously, Mr. Sarsfield was a senior leader in Goldman Sachs’ Investment Banking Division, where he served as Global Head of the Financial Institutions Group, Global Chief Operating Officer of Investment Banking, and Co-Head of the Healthcare Group in the Americas. Additionally, he served as a member of the firm’s Management Committee and Partnership Committee. Mr. Sarsfield currently serves as Vice President of the Board of Trustees of the Montclair Kimberley Academy and Treasurer of the Board of Safe Horizon, the largest victim services agency in the United States. Mr. |

2024 Proxy Statement | 7 |

Matters to Come Before the Annual Meeting | |

Sarsfield earned an MBA from Harvard Business School and a BA, magna cum laude, from Harvard College. Committees: • N/A |

Continuing Class I Directors (Term Expires 2025)

C. Clark Webb |

Title: Executive Vice Chairman and Director | Age: 43 | Director Since: 2017 |

Career Highlights Mr. Webb is one of the two directors designated by the 210 Group. He served as the Company’s Co-Chief Executive Officer from 2017 until October 2023 and as a director of the Company since 2017. Mr. Webb brings to the board extensive investment and managerial experience. In addition to his role at P10, Mr. Webb is also the Co-Founder and Principal of 210 Capital. Previously, Clark was co-founder and manager of P10 Capital Management, LP, a Co-Portfolio Manager of the Lafayette Street Fund and a Partner at Select Equity Group, L.P. Mr. Webb holds a BA from Princeton University (2003). Mr. Webb also currently serves as the chairman of the Board of Directors of each of Elah Holdings, Inc., an investment holding company, and Collaborative Imaging, LLC, a healthcare technology and management services organization, and as member of the Board of Directors of Crossroads Impact Corp. He was formerly a director of Globalscape, Inc., a software developer offering secure enterprise FTP solutions. Committees: • N/A |

Scott Gwilliam |

Title: Director | Age: 54 | Director Since: 2021 |

Career Highlights Mr. Gwilliam brings to the board extensive investment and industry experience. Mr. Gwilliam is a co-founder of Keystone Capital Management, a Chicago-based investment firm, where he has served as the Managing Partner since 2017. Mr. Gwilliam also currently serves as a director of CONSOR Engineers, an infrastructure engineering firm, VDA Holdings, a building sciences consultancy, Clearwater, a water operations and management company, Inspire 11, a leading digital transformation and data analytics firm, Merge, a full-service marketing agency, and Pinchin Holdings, an environmental, engineering, building science, and health & safety consulting firm. Prior to founding Keystone, Mr. Gwilliam was with Madison Dearborn Partners, a leading middle market private equity firm, and Kidder, Peabody & Company, a New York-based Investment Banking firm. Mr. Gwilliam received a B.S. degree in finance from the University of Virginia and a M.B.A. from Northwestern University. He has served as a director of the Company since October 2021. Committees: • Nominating and Corporate Governance (Chair) |

Edwin Poston |

Title: Director | Age: 57 | Director Since: 2021 |

Career Highlights Mr. Poston brings extensive private equity experience to the Board of Directors of the Company, where he has served as the director designated by TrueBridge Capital Partners LLC and certain of its affiliates since October 2021. He is a General Partner and co-founder of TrueBridge Capital Partners LLC, a principal operating brand of the Company. Prior to founding TrueBridge Capital Partners LLC, he was a Managing Director and Head of Private Equity at The Rockefeller Foundation, a private foundation to empower the world’s poor, where he focused particularly on private assets, including building and managing the Foundation’s venture capital and buyout portfolios both domestically and internationally. Prior to The Rockefeller Foundation, Mr. Poston was at Brandywine Trust Company, a multi-family office where he worked across a portfolio of more than $4 billion for a limited number of high-net-worth families and foundations. As the senior investment professional, he was responsible for all asset classes but spent the majority of his time on buyouts, venture capital, hedge funds, international equities, small cap equities, and concentrated portfolios. Prior to starting his career in private equity investing, Mr. Poston worked as an investment banker at NationsBanc Montgomery Securities (Bank of America Securities) and as an opportunistic real estate investor in Washington, D.C. Mr. Poston received a J.D. and M.B.A. from Emory University, and a B.A. from the University of North Carolina at Chapel Hill. Committees: • N/A |

8 | P10, Inc. |

Matters to Come Before the Annual Meeting | |

Continuing Class II Directors (Term Expires 2026)

Tracey Benford |

Title: Director | Age: 55 | Director Since: 2024 |

Career Highlights Ms. Benford was appointed to the Board in April 2024. Ms. Benford is a retired partner and advisory director of Goldman Sachs & Co., where she was a partner since 2010 and spent over 25 years of her career. Ms. Benford has held senior leadership positions at Goldman Sachs including as head of the Global Markets Division in the Midwest, Canada and the Southern Region, and served on the Global Executive Committee for Global Markets and the Partnership committee. She currently serves on the boards of several non-profit organizations including United States Olympic and Paralympic Foundation (USOPF), the Lincoln Park Zoo, Team Impact, Positive Coaching Alliance and Uniting Voices of Chicago and sits on the advisory council of the Stanford Graduate School of Business. Ms. Benford holds an MBA from the Stanford University Graduate School of Business and a BA, with honors, in Mathematical Methods and Economics from Northwestern University. Committees: • Audit • Compensation (Chair) • Nominating and Corporate Governance |

David M. McCoy |

Title: Director | Age: 50 | Director Since: 2023 |

Career Highlights Mr. McCoy is the director designated by the RCP Group. Mr. McCoy is a Managing Partner and portfolio manager for the Firm’s co-investment funds and maintains broader activities throughout the investment function. Mr. McCoy is also on the Investment Committee and active as an Advisory Board member of various underlying funds and portfolio companies. He has been involved in the private equity industry since 1998. Prior to joining RCP, Mr. McCoy was a Partner at National City Equity Partners, the private equity/mezzanine arm of PNC Financial Services Group, Inc. He has prior private equity experience at Thayer Capital Partners, operational experience at Suntron Corporation, an electronics contract manufacturer, and investment banking experience at BT Alex Brown. Mr. McCoy received a BA in Economics from Princeton University and an MBA from The Wharton School at the University of Pennsylvania. Committees: • N/A |

Robert B. Stewart, Jr. |

Title: Director | Age: 58 | Director Since: 2021 |

Career Highlights Mr. Stewart brings to the board extensive experience in intellectual property, patent licensing, financial and public markets. Mr. Stewart currently serves as Chairman of the Board of PopID, a company that provides solutions for verifying an individual’s identity through facial recognition software. Mr. Stewart is the former President of Acacia Research Corporation, an industry leader in patent licensing. Mr. Stewart was an executive at Acacia for over two decades, helping to deliver hundreds of millions of dollars of value to Acacia’s patent partners. Mr. Stewart received a B.S. degree from the University of Colorado at Boulder. He has served on the Board of Directors of the Company since October 2021. Committees: • Audit (Chair) • Compensation • Nominating and Corporate Governance |

2024 Proxy Statement | 9 |

Matters to Come Before the Annual Meeting | |

Vote Required

Each Class III director will be elected by a plurality of the votes cast at the annual meeting (assuming a quorum is present). The three nominees for Class III director receiving the highest number of affirmative votes will be elected. Consequently, any shares not voted at the annual meeting, whether due to abstentions, broker non-votes or otherwise, will have no impact on the election of the directors. Shares of common stock represented by executed, but unmarked, proxy cards will be voted in favor of the election as directors of the persons named as nominees in this Proxy Statement; provided that, if you hold your shares of our common stock through a broker-dealer, bank nominee, custodian or other securities intermediary, the intermediary will not vote those shares for the election of any nominee for director unless you give the intermediary specific voting instructions on a timely basis directing the intermediary to vote for such nominee.

Each of the foregoing nominees has consented to be named in this Proxy Statement and agreed to serve as a director if elected. Our Board of Directors has no reason to believe that the listed nominees will be unable or unwilling to serve as directors if elected. However, if any nominee should be unable to serve or will not serve, then the shares represented by proxies received will be voted for another nominee selected by our Board of Directors.

| Recommendation of the Board of Directors The Board of Directors unanimously recommends a vote “FOR” the election of each nominee |

10 | P10, Inc. |

Matters to Come Before the Annual Meeting | |

Board Meetings; Corporate Governance; Committees and Membership

Independent Directors

Our Board of Directors has unanimouslydetermined that Mr. Stewart, Mr. Gwilliam, Mr. Barnes, and Ms. Benford are “independent” as defined under the rules of the NYSE. In making this determination, the Board of Directors considered the relationships that Mr. Stewart, Mr. Gwilliam, Mr. Barnes, and Ms. Benford have with our Company and all other facts and circumstances that the Board of Directors deemed relevant in determining their independence, including ownership interests in us and, in the case of Mr. Gwilliam, the transactions involving Keystone Capital Management and its affiliates described in the section titled "Certain Relationships and Related Party Transactions."

We are a “controlled company” under the rules of the NYSE by virtue of the Controlled Company Agreement, and therefore qualify for an exemption from the requirement that our Board of Directors consist of a majority of independent directors, that we establish a Compensation Committee consisting solely of independent directors and that our director nominees be selected or recommended by independent directors.

Board Leadership Structure

Our board annually reviews its leadership structure to evaluate whether the structure remains appropriate for the Company. Our board does not have a policy on whether the role of Chairman and Chief Executive Officer should be separate or combined. In October 2023, our board determined it was in the Company’s best interest to transition the leadership of the Company and separate the role of Chairman and Chief Executive Officer. The Board appointed Mr. Sarsfield as the Company’s new Chief Executive Officer and Messrs. Alpert and Webb as Executive Chairman and Executive Vice Chairman, respectively. Our board may make further changes to the Company’s leadership structure in the future.

Executive Sessions

In order to promote open discussion among independent directors, our board holds executive sessions of independent directors at least quarterly. These executive sessions are chaired by a director selected by the independent directors during such sessions.

Board Qualifications & Diversity

The Nominating and Corporate Governance Committee periodically reviews, and recommends to our board, the skills, experience, characteristics and other criteria for identifying and evaluating directors. Our board expects directors to be open and forthright, to develop a deep understanding of the Company’s business, and to exercise sound judgment and courage in fulfilling their oversight responsibilities. Directors should embrace the Company’s values and culture and should possess the highest levels of integrity.

The Nominating and Corporate Governance Committee evaluates the composition of our board annually to assess whether the skills, experience, characteristics and other criteria established by our board are currently represented on our board as a whole, and in individual directors, and to assess the criteria that may be needed in the future in light of the Company’s anticipated needs. Our Board of Directors and the Nominating and Corporate Governance Committee also actively seek to achieve a diversity of occupational and personal backgrounds on the Board, including diversity with respect to demographics such as gender, race, ethnic and national background, geography, age and sexual orientation.

In April 2024, our Nominating and Corporate Governance Committee recommended, and our Board approved, appointing Ms. Benford to the Board. Ms. Benford brings a diversity of skills and background to the Board, particularly given her 30+ years of financial services experience.

The Nominating and Corporate Governance Committee reviews the qualifications of director candidates and incumbent directors in light of the criteria approved by our board and recommends the Company’s candidates to our board for election by the Company’s stockholders at the applicable annual meeting. We believe our board is well positioned to provide effective oversight and strategic advice to our management.

Procedures for Recommending Individuals to Serve as Directors

The Nominating and Corporate Governance Committee also considers director candidates recommended by our stockholders that are submitted in accordance with our amended and restated bylaws (“bylaws”). Any stockholder who wishes to propose director nominees for consideration by our Nominating and Corporate Governance Committee, but does not wish to present such proposal at an annual meeting of stockholders, may do so at any time by sending each proposed nominee’s name and a description of his or her qualifications for board membership to the chair of the Nominating and Corporate Governance Committee by sending an email to acoussens@p10alts.com or in writing, c/o our Secretary, at 4514 Cole Ave, Suite 1600, Dallas, TX, 75205. The recommendation should contain all of the information regarding the nominee required under the “advance notice” provisions of our bylaws (which can be provided free of charge upon request by writing to our Secretary at the address listed above). The Nominating and Corporate Governance Committee evaluates nominee proposals submitted by stockholders in the same manner in which it evaluates other director nominees.

2024 Proxy Statement | 11 |

Matters to Come Before the Annual Meeting | |

Board Committees

Our Board of Directors has standing Audit, Compensation, and Nominating and Governance Committees. The Board of Directors has adopted, and may amend from time to time, a written charter for each of the Audit Committee, Compensation Committee, and Nominating and Governance Committee.

Audit Committee |

Members: Robert Stewart, Jr. (Chair) | Travis Barnes | Tracey Benford |

Mr. Stewart, Mr. Barnes, and Ms. Benford are independent directors under the independence standards of the NYSE and SEC rules. Our Board of Directors has determined that each of Mr. Stewart, Mr. Barnes and Ms. Benford qualifies as an “audit committee financial expert,” as defined by the SEC. In 2023, the Audit Committee held 5 meetings and its members were Robert Stewart, Jr., Scott Gwilliam, and Travis Barnes. Our Audit Committee, among other things, has the primary duties and responsibilities to assist our Board of Directors in: • appointing, determining the compensation of and overseeing the work of our independent registered public accounting firm, as well as evaluating its independence and performance; • considering and approving, in advance, all audit and non-audit services to be performed by our independent registered public accounting firm; • reviewing the audit plans and findings of our independent registered public accounting firm and our internal audit and risk review staff, as well as the results of regulatory examinations, and tracking management’s corrective action plans where necessary; • reviewing our financial statements, including any significant financial items and/or changes in accounting policies, with our senior management and independent registered public accounting firm; • reviewing our financial risk and control procedures, compliance programs and significant tax, legal and regulatory matters, including cybersecurity risk management; and • establishing procedures for the receipt and treatment of complaints and employee concerns regarding our financial statements and auditing process. A copy of our audit committee charter is available at: https://ir.p10alts.com/governance-documents. |

Compensation Committee |

Members: Tracey Benford (Chair) | Travis Barnes | Robert Stewart, Jr. |

In 2023, the Compensation Committee held 7 meetings and its members were Scott Gwilliam, Robert Stewart, Jr., and Travis Barnes. The Compensation Committee is responsible for: • reviewing and approving corporate goals and objectives relevant to Co-Chief Executive Officers’ compensation, evaluating the Co-Chief Executive Officers’ performance in light of those goals and objectives, and determining the Co-Chief Executive Officers’ compensation based on that evaluation; • reviewing and recommending to our board for approval the annual base salaries, bonuses, benefits, equity incentive grants and other economic rewards for our other executive officers; • providing assistance and recommendations with respect to our compensation policies and practices for our other personnel generally; and • overseeing our 2021 Incentive Plan and employee benefit plans. A copy of our compensation committee charter is available at: https://ir.p10alts.com/governance-documents. |

Nominating and Corporate Governance Committee |

Members: Scott Gwilliam (Chair) | Tracey Benford | Robert Stewart, Jr. |

The Nominating and Corporate Governance Committee held 4 meetings in 2023 and its members were Scott Gwilliam, Robert Stewart, Jr., and Travis Barnes. Our Nominating and Corporate Governance Committee, among other things, is responsible for: • identifying individuals qualified to become members of our Board of Directors, consistent with criteria approved by our Board of Directors; and • developing and recommending to our Board of Directors a set of corporate governance guidelines and principles. A copy of our Nominating and Corporate Governance committee charter is available at: |

Board Risk Oversight

Our Board of Directors is submittingresponsible for stockholder overseeing our risk management process. Our Board of Directors focuses on our general risk management strategy and the most significant risks facing us and oversees the implementation of risk mitigation strategies by management. Our Board of Directors is also apprised of particular risk management matters in connection with its general oversight and

12 | P10, Inc. |

Matters to Come Before the Annual Meeting | |

approval of corporate matters and significant transactions.

While the full Board of Directors has the ultimate oversight responsibility for the risk management process, its committees will oversee risk in certain specified areas. In particular, our audit committee oversees management of enterprise risks, financial risks and risks associated with corporate governance, business conduct and ethics and is responsible for overseeing the review and approval of related-party transactions. Our compensation committee is responsible for overseeing the management of risks relating to our executive compensation plans and arrangements and the incentives created by the compensation awards it administers. Pursuant to the Board of Directors’ instruction, management regularly reports on applicable risks to the relevant committee or the full Board of Directors, as appropriate, with additional review or reporting on risks conducted as needed or as requested by the Board of Directors and its committees.

Corporate Governance Guidelines

Our corporate governance guidelines, in accordance with the NYSE reporting requirements, is available at: https://ir.p10alts.com/governance-documents.

Code of Ethics

Our code of ethics satisfies the requirement that we have a “code of conduct” under applicable NYSE rules, a copy of which is available at: https://ir.p10alts.com/governance-documents. We intend to disclose future amendments to certain provisions of this code of business ethics, or waivers of such provisions, applicable to any principal executive officer, principal financial officer, principal accounting officer or controller, or persons performing similar functions, and our directors, on our website identified above.

Insider Trading Policy

Our Board of Directors has adopted an insider trading policy that applies to all of its officers, directors and employees. Officers, directors and employees are prohibited from engaging in any of the following types of transactions with respect to the Company’s securities: (i) short sales, including short sales “against the box”, (ii) purchases or sales of puts, calls, or other derivative securities or (iii) purchases of financial instruments (including prepaid variable forward contracts, equity swaps, collars and exchange funds) or other similar transactions that directly hedge or offset, or are designed to directly hedge or offset, any decrease in the market value of Company securities.

Clawback Policy

In 2023, we adopted a clawback policy that provides for the recovery of all erroneously awarded compensation received by an executive officer in the event of an accounting restatement due to material noncompliance with any financial reporting requirement under the securities laws, as required under Section 10D of the Exchange Act, Rule 10D-1 promulgated under the Exchange Act and Section 303A.14 of the New York Stock Exchange Listed Company Manual. .

Meetings and Attendance

Our Board of Directors held 11 meetings in 2023. Each of the directors currently serving on our Board of Directors attended at least 75% of the aggregate number of meetings of the Board of Directors held in 2023 and meetings held by each committee of the Board of Directors on which such director served during the period that the director so served in 2023. Directors are expected to attend our annual meeting of stockholders each year.

Communications with the Board of Directors

You may communicate with our Board of Directors by writing to our Corporate Secretary at P10, Inc., 4514 Cole Ave, Suite 1600, Dallas, TX 75205. The Corporate Secretary will deliver this communication to the Board of Directors or the specified director, as the case may be, if they relate to appropriate and substantive corporate or Board of Directors matters. Communications that are of a commercial or frivolous nature, or otherwise inappropriate for the Board of Director’s consideration, will not be forwarded to the Board of Directors.

Policies and Procedures Regarding Related Person Transactions

Our Board of Directors has adopted written policies and procedures regarding related person transactions. For purposes of these policies and procedures:

Each of our executive officers, directors or nominees for director is required to disclose to the Audit Committee certain information relating to related person transactions for review, approval or ratification by the Audit Committee. Disclosure to the Audit Committee should occur before, if possible, or as soon as practicable after the related person transaction is effected, but in any event as soon as practicable after the executive officer, director or nominee for director becomes aware of the related person transaction. The Audit Committee’s decision whether or not to approve or ratify a related person transaction is to be made in light of the Audit Committee’s determination that consummation of the transaction is not or was not contrary to our best interests. Any related person transaction must be disclosed to the

2024 Proxy Statement | 13 |

Matters to Come Before the Annual Meeting | |

full Board of Directors.

Certain Relationships and Related Party Transactions

Our related party transactions include:

Effective January 1, 2021, the Company entered into a sublease with 210 Capital, LLC, a related party, for office space serving as our corporate headquarters. The monthly rent expense is $20.3 thousand, and the lease expires December 31, 2029. In the fourth quarter of 2022, the Company sublet an additional amount of office space in the corporate headquarters. This contributed an additional $3.4 thousand monthly. P10 has paid $0.3 million in rent to 210 Capital, LLC for the year ended December 31, 2023.

Through its subsidiaries, the Company serves as the investment manager to our existing portfolio of solutions across private equity, venture capital, private credit and impact investing (collectively, the “Funds”). Certain expenses incurred by the Funds are paid upfront and are reimbursed from the Funds as permissible per fund agreements. As of December 31, 2023, the total accounts receivable from the Funds totaled $18.9 million, of which $5.5 million related to reimbursable expenses and $13.4 million related to fees earned but not yet received. The management fees described here are included in accounts receivable on the Consolidated Balance Sheets and the reimbursable expenses are included in due from related parties on the Consolidated Balance Sheets.

Upon the closing of the Company’s acquisition of ECG and ECP, the Advisory Agreement between ECG and Enhanced PC immediately became effective. Under this agreement, ECG provides advisory services to Enhanced PC related to the assets and operations of the permanent capital subsidiaries owned by Enhanced PC, as contributed by both ECG and ECP, and new projects undertaken by Enhanced PC. In exchange for those services, which commenced on January 1, 2021, ECG receives advisory fees from Enhanced PC based on a declining fixed fee schedule, that is commensurate with the level of services being performed as the projects expire. The Company did not adjust the promised amount of consideration for the effects of a significant financing component at each contract inception as the Company expected that the period between services being provided and cash collection would be less than one year. The total advisory fees are $107.5 million over 9 years. Inclusive of new projects added since inception. This agreement is subject to customary termination provisions. Since inception, $62.0 million of the total $107.5 million advisory fees have been recognized as revenue. There was $45.5 million in remaining performance obligations related to this agreement, which will be recognized between January 1, 2024 and December 31, 2030. For the year ended December 31, 2023, advisory fees earned or recognized under this agreement were $20.9 million and is reported in management and advisory fees on the Consolidated Statements of Operations. The Company also earns interest income on the balance outstanding. Revenues from interest were $0.7 million for the year ended December 31, 2023, which is included in management and advisory fees on the Consolidated Statements of Operations. As of December 31, 2023, the associated receivable was $48.5 million and is included in due from related parties on the Consolidated Balance Sheets. Payment is expected to be collected as the permanent capital subsidiaries complete and liquidate multi-year projects covered under this agreement.

Upon the closing of the Company’s acquisition of ECG and ECP, the Administrative Services Agreement between ECG and Enhanced Capital Holdings, Inc. (“ECH”), the entity which holds a controlling equity interest in ECP, immediately became effective. Under this agreement, ECG pays ECH for the use of their employees to provide services to Enhanced PC at the direction of ECG. The invoice associated with this agreement is paid quarterly in arrears and subject to 5% of interest per annum. The Company recognized $13.2 million for the year ended December 31, 2023 related to this agreement within compensation and benefits on our Consolidated Statements of Operations. As of December 31, 2023, the associated accrual was $2.1 million and is included in due to related parties on the Consolidated Balance Sheets.

On September 10, 2021, Enhanced entered into a strategic partnership with Crossroads Impact Corp (“Crossroads”), parent company of Capital Plus Financial (“CPF”), a leading certified development financial institution. Under the terms of the agreement, Enhanced will originate and manage loans across its diverse lines of business including small business loans to women and minority owned businesses, and loans to renewable energy and community development projects. The loans will be held by CPF and CPF will pay an advisory fee to Enhanced.

On July 6, 2022, Crossroads entered into the Advisory Agreement (the “Crossroads Advisory Agreement”) with ECG. The Crossroads Advisory Agreement provides for ECG to receive a services fee of approximately 1.5% per year of the capital deployed by Crossroads under the Crossroads Advisory Agreement (0.375% quarterly) and an incentive fee of 15% over a 7% hurdle rate. In relation to the strategic partnership with Crossroads effective September 10, 2021 and the Crossroads Advisory Agreement, the Company recognized $8.9 million of fees for the year ended December 31, 2023 which is included in management and advisory fees on the Consolidated Statements of Operations.

On July 6, 2022, certain funds managed by the Company purchased 4,646,840 shares of Crossroads common stock at $10.76 per shares, for an aggregate amount of approximately $50 million. On August 1, 2022, an additional purchase of 1,394,052 shares of Crossroads common stock at $10.76 per share occurred. The funds managed by the Company do not have the ability to change the investment strategy of Crossroads. Two members of the Board of Directors of the Company, including the Executive Chairman, are also directors of Crossroads. and have recused themselves from any decisions related to Crossroads or CPF. The Company recognizes an annual fee from the funds of $20 thousand of which $20 thousand has been recognized for the year ended December 31, 2023 which is included in management and advisory fees on the Consolidated Statements of Operations.

Upon the closing of the Bonaccord acquisition on September 30, 2021, an Advance Agreement and Secured Promissory Note was signed with BCP, an entity that was formed by employees of the Company. As of December 31, 2023 the total notes receivable balance was $5.8 million. The Company recognized interest income of $0.3 million for the year ended December 31, 2023.

Additional Secured Promissory Notes were signed with certain Bonaccord employees on October 13, 2023.

14 | P10, Inc. |

Matters to Come Before the Annual Meeting | |

One of our directors, Scott Gwilliam, is a non-controlling member of Keystone Capital XXX, LLC (“Keystone XXX”), and a non-controlling member in KCI Funds III, LLC, KCI Funds V, LLC, and KCI Funds VI, LLC (together the “KCI Funds”), which all have the right, pursuant to prior contractual agreements between Keystone XXX and the Company, to invest in the Company’s funds on certain preferential terms. Pursuant to such agreements, the KCI Funds have invested in certain of the Company’s funds on the same terms and conditions as other unaffiliated clients and investors, except that these investments are generally not subject to management fees or carried interest. In addition, certain of the KCI Funds’ investments are also directly in the respective general partner entity for certain funds, and share in the carried interest. Certain of the KCI Funds’ investments are also directly in the respective general partner entity for certain funds, and share in the carried interest. In addition, certain funds managed by or separate managed accounts of RCP Advisors (the "RCP Funds") have invested $75 million and $75 million, respectively, in capital with two investment funds managed by Keystone Capital Management, where Mr. Gwilliam is a managing partner, and may continue to do so in the future. The RCP Funds have also, on behalf of its clients, partnered with Keystone Capital Management in the acquisition of certain businesses on a direct basis. The RCP Funds invest, on behalf of their clients, on substantially the same terms and conditions as other clients in these funds, including being subject to management fees and carried interest payable to affiliates of Keystone Capital Management, which totaled $0.3 million (net of fee offsets and fee waivers) for the year ended December 31, 2023. These fees are not included in the Consolidated Statements of Operations as they are fees paid to Keystone Capital Management on behalf of RCP clients.

The Company’s officers and directors have also directly invested in certain of the Company’s funds on substantially the same terms and conditions as other unaffiliated clients and investors, except that these investments are sometimes not subject to management fees or carried interest.

Controlled Company Agreement

P10, Inc. entered into the Controlled Company Agreement on October 20, 2021, with the 210 Group, the RCP Group and the TrueBridge Group, granting each party certain board designation rights. Under the Controlled Company Agreement, so long as the 210 Group continues to collectively hold a combined voting power of (A) at least 10% of the shares of common stock outstanding immediately following the closing date of the IPO (the “Closing Date”), P10, Inc. shall include in its slate of nominees two (2) directors designated by the 210 Group and (B) less than 10% but at least 5% of the shares of common stock outstanding immediately following the Closing Date, one (1) director designated by the 210 Group. So long as the RCP Group and any of their permitted transferees who hold shares of common stock as of the applicable time continue to collectively hold a combined voting power of at least 5% of the shares of common stock outstanding immediately following the IPO, P10, Inc. shall include in its slate of nominees one (1) director designated by the RCP Stockholders. So long as TrueBridge and any of its permitted transferees who hold shares of common stock as of the applicable time continue to collectively hold a combined voting power of at least 5% of the shares of common stock outstanding immediately following the IPO, P10, Inc. shall include in its slate of nominees one (1) director designated by the TrueBridge Group.

The 210 Group, the RCP Group and TrueBridge Group have the right to designate two, one and one directors, respectively. In addition, the parties to our Controlled Company Agreement will agree to elect three directors who are not affiliated with any party to our Controlled Company Agreement and who satisfy the independence requirements applicable to audit committee members established pursuant to Rule 10A-3 under the Exchange Act. These board designation rights are subject to certain limitations and exceptions.

The Controlled Company Agreement provides that, without the prior written consent of P10, Inc., the 210 Group, the RCP Group and the TrueBridge Group will not, and will not publicly disclose an intention to, during the period commencing on the date of the Controlled Company Agreement and ending three years after the date thereof (the “Restricted Period”), (a) offer, pledge, sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant any option, right or warrant to purchase, lend, or otherwise transfer or dispose of, directly or indirectly, any shares of common stock beneficially owned (as such term is used in Rule 13d-3 of the Exchange Act) by the 210 Group, RCP Group or the TrueBridge Group or any other Equity Securities (as defined therein) or (b) enter into any swap or other arrangement that transfers to another, in whole or in part, any of the economic consequences of ownership of the Equity Securities, whether any such transaction described in clause (a) or (b) above is to be settled by delivery of shares of common stock or any such other securities, in cash or otherwise. One-third of the original holdings of Equity Securities of each of the 210 Group, RCP Group and TrueBridge Group were released from the Lock-Up Restrictions, on each of the first and second anniversary of the consummation of the IPO and one-third of such original holdings will be released from the Lock-Up Restrictions, on the third anniversary of the consummation of the IPO. Stockholders Agreement and Registration Rights P10, Inc. entered into a stockholders agreement with certain investors, including employees, pursuant to which the investors were granted piggyback and demand registration rights prior to the IPO.

Company Lock-Up Agreements

Certain stockholders are subject to Lock-Up Restrictions pursuant to a separate agreement with us, which Lock-Up Restrictions shall be released in accordance with the Lock-Up Restrictions Release.

Stock Repurchase Program

On May 12, 2022, we announced that our Board of Directors authorized a program to repurchase outstanding shares of our Class A and Class B common stock as of the date of authorization, not to exceed $20 million (the “Stock Repurchase Program”). On December 27, 2022, we announced that our Board of Directors authorized an additional $20 million for repurchases under the Stock Repurchase Program. On February 27, 2024, the Board of Directors authorized an additional $40.0 million of repurchases of outstanding Class A and B shares of the Company's stock under the Stock Repurchase Program. The authorization provides us the flexibility to repurchase shares in the open market, in block trades, in accordance with Rule 10b5-1 trading plans, and/or through other legally permissible means, in privately negotiated transactions, from time to time, based on market conditions and other factors. The Stock Repurchase Program does not obligate P10 to acquire any particular amount of common stock and it may be terminated or amended by the Board of Directors at any time.

2024 Proxy Statement | 15 |

Matters to Come Before the Annual Meeting | |

Pursuant to the Stock Repurchase Program, the Company purchased: (a) 100,000 shares of Class B common stock on March 16, 2023, from the Jeff P. Gehl Living Trust, at a price of $8.51 per share; (b) 30,000 shares of Class B common stock on December 8, 2023, from Michael Feinglass at a price of $9.14 per share; and (c) 50,000 shares of Class B common stock on November 21, 2023, from Richard Montgomery at a price of $8.60 per share. Each of the foregoing sellers may be deemed to be a related person of the Company because they are a party to the Controlled Company Agreement. The sales price per share for each of the foregoing transactions represented approximately an 8% discount on the then-most recently reported closing price for shares of Class A common stock.

16 | P10, Inc. |

Matters to Come Before the Annual Meeting | |

Executive Officers

The names, ages and positions held by the current executive officers of the Company are presented below.

Executive Officer | Age | Position |

Luke A. Sarsfield III | 50 | Chief Executive Officer |

Amanda Coussens | 43 | Chief Financial Officer and Chief Compliance Officer |

Mark Hood | 59 | Executive Vice President and Chief Administrative Officer |

Arjay Jensen | 52 | Executive Vice President and Head of Strategy and M&A |

Robert Alpert | 59 | Executive Chairman |

C. Clark Webb | 43 | Executive Vice Chairman |

Luke A. Sarsfield III—see biographical information in “Proposal 1: Election of Directors—Nominees for Election as Class III Directors at the Annual Meeting (Term to Expire 2027)—Luke A. Sarsfield III.”

Amanda Coussens is the Company’s Chief Financial Officer and Chief Compliance Officer. Prior to becoming the Company’s Chief Financial Officer in January 2021, Amanda served as Chief Financial Officer and Chief Compliance Officer of PetroCap LLC from October 2017 to December 2020; as a contract Chief Financial Officer for Aduro Advisors LLC from March 2016 to November 2017; and as Chief Financial Officer of White Deer Energy LLC from June 2014 to March 2016. Prior to this time, Ms. Coussens served as the SEC Reporting Director for a publicly traded asset manager, The Edelman Financial Group, Director of Accounting for a large family office and Controller for Tudor, Pickering, Holt & Co. Ms. Coussens started her career as an audit manager at Grant Thornton for publicly traded companies in the financial institutions and services, energy and hospitality industries. She is also a licensed CPA in Texas, and the Audit Committee Chair and Independent Board Director for Granite Ridge Resources, Inc. (NYSE: GRNT). Ms. Coussens is also a board member of the Dallas chapter of the Private Equity CFO Association, a thought-leadership and networking organization, and an auxiliary board member of New Friends, New Life, a nonprofit organization that supports anti-trafficking efforts in the U.S.

Mark Hood is the Company’s Executive Vice President and Chief Administrative Officer, a position he has served in since February 2024. Prior to that, he served as the Company’s Executive Vice President of Operations and Director of Investor Relations from February 2023 until February 2024, and as Director of Investor Relations from October 2021 until February 2023. Prior to joining P10, Mr. Hood was chief operating officer at Bespoke Partners, a leading executive search firm serving the private equity industry, from January 2021 to August 2021. Before that, Mr. Hood worked at GlobalScape, Inc. (NYSE American: GSB), a software company, serving as chief operating officer from January 2020 until August 2020, as Executive Vice President of Operations from May 2019 until December 2019 and as Vice President of Operations from August 2018 until May 2019. Prior to GlobalScape, Mr. Hood served in various roles at Crossroads Systems, Inc., a data software and hardware firm, from January 2013 until August 2018, including most recently as Executive Vice President from August 2017 until August 2018. Mr. Hood earned a Bachelor of Business Administration in Marketing from Sam Houston State University and a Master of Science in Technology Commercialization from The University of Texas at Austin, McCombs School of Business.

Arjay Jensen is the Company’s Executive Vice President and Head of Strategy and M&A, a position he has served in since February 2024. Prior to joining P10, Mr. Jensen held a variety of roles in investment banking, focusing on M&A and other strategic and corporate finance transactions for financial services companies, including serving as managing director at Goldman, Sachs & Co. on the Financial Institutions Group’s M&A team from December 2021 to September 2023, as managing director at Guggenheim Securities in the Financial Institutions Group of from 2014 until October 2021 and as managing director in the Financial Advisory group of Perella Weinberg Partners from 2009 to 2014. Mr. Jensen earned a MBA from Duke University, where he was a Fuqua Scholar, and a BA in Economics from the University of Michigan.

Robert Alpert—see biographical information in “Proposal 1: Election of Directors—Nominees for Election as Class III Directors at the Annual Meeting (Term to Expire 2027)—Robert Alpert.”

C. Clark Webb—see biographical information in section “Proposal 1: Election of Directors—C. Clark Webb.”

2024 Proxy Statement | 17 |

Matters to Come Before the Annual Meeting | |

Director Compensation

Our policy is to not pay director compensation to directors who are also our employees. Our non-employee directors are paid an annual fee up to $175,000. In 2023, the annual fee of $150,000 was payable half in shares of restricted stock, and our directors were able to elect whether to receive the remaining half of their fees in shares of restricted stock, in cash, or in a combination of shares of restricted stock and cash. In the third quarter of 2023, our Board of Directors increased the annual fee to $175,000, and the additional $25,000 in fees were paid in cash. Any amount elected to be received in cash will be paid at the time of vesting of the accompanying restricted stock award. For 2024, the annual fee will be payable entirely in shares of restricted stock. In addition, all members of the Board of Directors are reimbursed for reasonable costs and expenses incurred in attending meetings of our Board of Directors.

The following table sets forth information regarding the compensation earned or received by each of our non-employee directors during fiscal year 2023. Because Ms. Benford joined the Board of Directors in April 2024, she did not receive compensation in 2023 and is not listed below.

Name |

| Fees Paid in Cash |

|

|

| Stock Awards (1) |

|

| Total |

| |||

Scott Gwilliam |

| $ | 25,000 |

|

|

| $ | 150,000 |

|

| $ | 175,000 |

|

Travis Barnes |

| $ | 25,000 |

|

|

| $ | 150,000 |

|

| $ | 175,000 |

|

Robert B. Stewart, Jr. |

| $ | 100,000 |

| (2) |

| $ | 75,000 |

|

| $ | 175,000 |

|

18 | P10, Inc. |

Matters to Come Before the Annual Meeting | |

Executive Compensation

Summary Compensation Table

The following table sets forth certain information concerning the compensation earned for 2023 and 2022 by (i) our Chief Executive Officer, (ii) our two former Co-Chief Executive Officers, (iii) our Chief Financial Officer & Chief Compliance Officer and (iv) our Chief Operating Officer. The persons named in the table are also referred to in this Proxy Statement as the “named executive officers.”

Name and Principal Position |

| Year |

| Salary |

|

| Bonus |

|

| Stock |

|

| Option |

|

| All Other |

|

|

| Total |

| ||||||

Luke Sarsfield |

| 2023 |

| $ | 190,972 |

|

| $ | — |

|

| $ | 7,000,005 |

|

| $ | — |

|

| $ | 94,673 |

| (7) |

| $ | 7,285,651 |

|

Chief Executive Officer |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|